Do I Need Travel Insurance For Gibraltar? It is not mandatory but highly recommended. It ensures your trip is safeguarded against unexpected events.

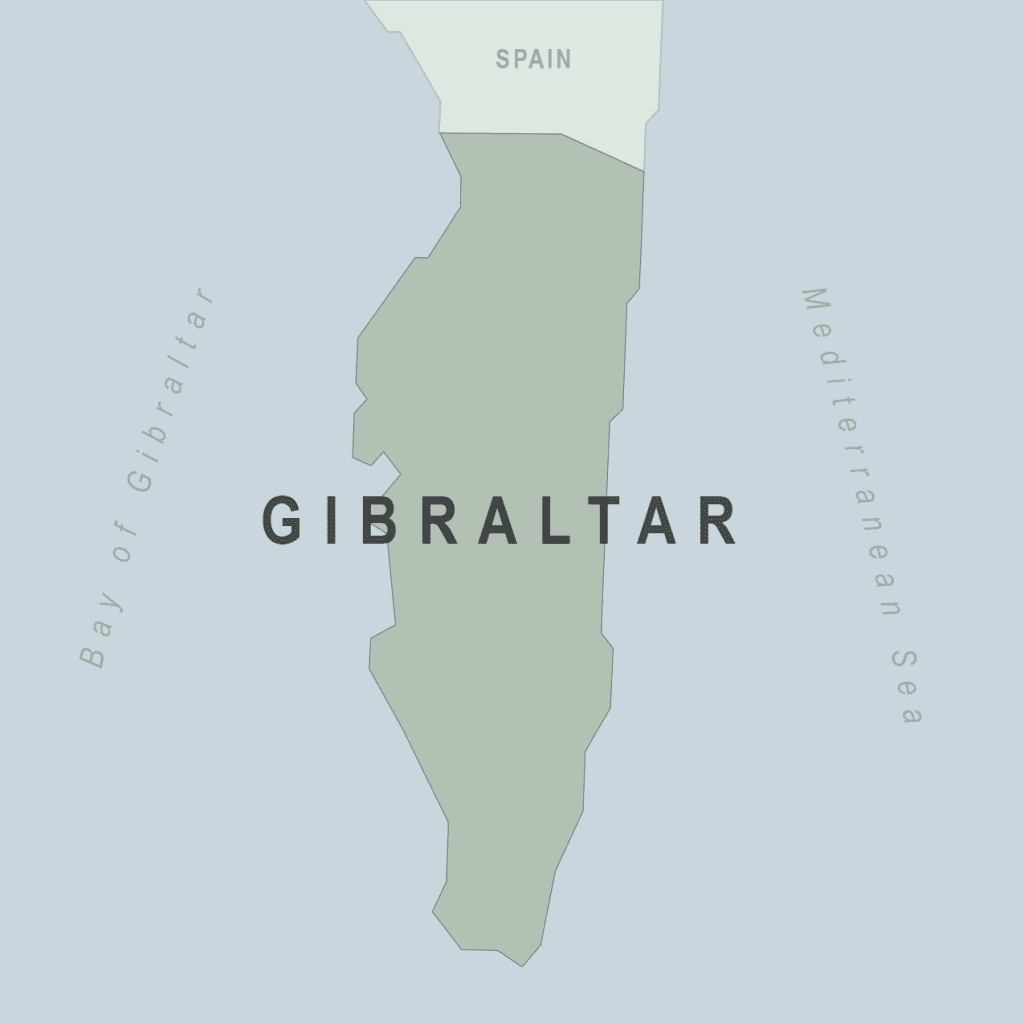

Nestled at the southern tip of the Iberian Peninsula, Gibraltar offers travelers a unique blend of British and Mediterranean experiences. Securing travel insurance before visiting this iconic Rock can be wise, considering potential travel hiccups like flight cancellations, lost luggage, or medical emergencies.

Gibraltar’s myriad attractions, from the legendary Rock itself to its historic siege tunnels, are best enjoyed with the peace of mind of knowing you’re protected. Whether you’re there to explore its natural wonders or bask in its rich cultural heritage, travel insurance can help ensure your journey remains uninterrupted by unforeseen complications.

The Importance Of Travel Insurance

Traveling can spark unexpected surprises. These surprises may only sometimes be pleasant. Travel insurance acts as a safety net. It protects you against the unpredictable.

Travel insurance is a must for savvy travelers. It offers protection for a range of scenarios. This includes trip cancellations, medical emergencies, and lost luggage. Gibraltar is no exception. Despite its political stability and modern healthcare system, the unexpected can happen.

Unexpected Events And Financial Risks And Do I Need Travel Insurance For Gibraltar?

Trips come with their share of uncertainties. Travel insurance helps shield you from unforeseen events that can disrupt your plans. Below are some situations where travel insurance is invaluable-

- Medical emergencies- Coverage for hospital visits or medical evacuations.

- Lost or delayed luggage- Compensation for the inconvenience.

- Flight cancellations- Reimbursement for non-refundable expenses.

- COVID-19-related issues- Protections for pandemic-related trip disruptions.

These are mere examples. Various other scenarios make travel insurance crucial for a worry-free trip to Gibraltar.

Peace Of Mind While Traveling

Feeling secure during your travels enhances the overall experience. Here’s why peace of mind is paramount-

- Allows you to enjoy your stay without fretting over ‘what-ifs.’

- Provides a safety buffer so you can make the most of your adventure.

- Ensures assistance is a phone call away, no matter the issue.

- Guards your investments in flights, accommodations, and experiences.

Investing in travel insurance for Gibraltar means you can relish the sights, tastes, and sounds without worry.

Gibraltar- A Unique Destination

Gibraltar is a beacon of uniqueness, beckoning travelers with its rich blend of cultures and fascinating history.

It is a sliver of Britain sitting on the southern tip of Spain.

Its famous Rock looms large, offering breathtaking views and welcoming diverse wildlife.

Gibraltar’s unique status makes it a must-see for those seeking experiences beyond the ordinary.

Why Gibraltar Is Different From Other Destinations

- Strategic Location- Perched between two continents, it offers a tapestry of European and African influences.

- Rich History- Its storied past spans from the Moors to modern times.

- Biodiversity- Home to the famous Barbary macaques and unique flora.

- Cultural Melting Pot- A fusion of British, Spanish, Genoese, and Portuguese heritage evident in language, cuisine, and architecture.

Local Healthcare System And Assistance For Travelers

Gibraltar’s healthcare system boasts state-of-the-art facilities and services.

Accessible medical Care caters to both residents and visitors.

However, differences in health insurance can result in unexpected costs.

Travel insurance ensures peace of mind during your unique journey.

Traveler’s Healthcare Guide for Gibraltar

State Healthcare Coverage Only with a valid European Health Insurance Card (EHIC)

Private Care Recommended for non-EU visitors

Pharmacies Widely available for non-prescription and prescription medicine

Emergency Services Call 112 for immediate assistance.

Assessing Your Travel Needs

Deciding whether to buy travel insurance for Gibraltar begins with understanding your trip’s specifics. A clever look at the trip duration and planned activities helps determine your insurance needs.

Duration And Nature Of Your Trip

A trip can range from a brief weekend getaway to an extended vacation. Consider the length of your stay, as longer trips often have a higher risk of unexpected events. Assess your accommodation and travel arrangements. Are your bookings refundable? The nature of your trip matters, too. A business journey poses different risks and necessities than a leisurely holiday. This information is critical in deciding the extent of coverage you need.

Do I need travel insurance for Gibraltar from the UK-

If you’re traveling from the UK to Gibraltar, it’s wise to consider travel insurance. While Gibraltar is a British Overseas Territory and may seem familiar, unexpected events such as medical emergencies, trip cancellations, or lost baggage can still occur.

Travel insurance can provide peace of mind by offering financial protection against these unforeseen circumstances, ensuring you can confidently enjoy your trip.

Activities Planned In Gibraltar

Gibraltar offers diverse attractions, from the Rock of Gibraltar to its lovely beaches. What’s on your itinerary? Are high-risk activities like rock climbing involved? You could delve into water sports or explore dense urban areas.

- For adventure sports, look for policies covering medical expenses from potential injuries.

- If cultural sites and restaurants are your focus, consider coverage for cancellations or theft.

Understanding your activity risk helps tailor your insurance plan. Make an informed decision on whether travel insurance is necessary for your Gibraltar adventure.

Coverage Options For Travelers To Gibraltar

Exploring Gibraltar’s stunning landscapes and rich history is a thrill for many travelers. Securing the right travel insurance ensures peace of mind throughout the journey. Different policies cover various scenarios. Let’s dive into the coverage options that can shield you from unexpected events in Gibraltar.

Medical Emergencies And Evacuations

In a medical pinch, the right insurance is your best friend. Healthcare expenses in foreign countries can be steep. Travel insurance for Gibraltar should include-

- Hospitalization costs- Pays for your medical bills if you get sick or injured.

- Emergency evacuation- Covers costs to transport you to a better-equipped facility or back home.

- Medication- Helps with the cost of prescribed drugs.

- Repatriation- Arranges for your return home if necessary due to medical reasons.

Trip Cancellations And Delays

Losing money over cancellations or delays is frustrating. Insurance plans can help you recoup costs. Look for coverage that handles-

- Non-refundable expenses- Reimburses you for pre-paid, non-refundable trip costs.

- Travel delays- Offers compensation for meals and accommodations during an unexpected delay.

- Missed connections- Assists if a delay causes you to miss a scheduled connection.

- Interruption- Provides funds to return home if your trip is cut short for covered reasons.

Traveling With Valuables

Imagine you’re exploring the Upper Rock in Gibraltar. Now, think about your valuables. A great travel insurance plan can keep those worries at bay. Let’s explore how to protect your belongings in Gibraltar.

Protecting Your Belongings

When touring Gibraltar, keeping valuables safe is crucial. Items like cameras, smartphones, and jewelry need extra Care, and travel insurance is a safety net. It helps if your belongings get lost, stolen, or damaged.

- Use hotel safes for essential items.

- Keep a close eye on your belongings in public areas.

- Choose insurance that covers personal items.

Insurance For High-risk Items

Some items carry higher risks when traveling. Gadgets, sporting equipment, and fancy clothes fall into this category. A good insurance policy should cover these high-risk items.

Item Type Risk Level Coverage Needed

Electronics High Comprehensive

Sporting Gear Medium Specific

Luxury Wear High Inclusive

Read the fine print on your policy. Make sure it matches your needs. Remember, some items might need separate insurance.

Legal And Liability Considerations

Traveling to Gibraltar? Understanding legal and liability aspects is critical. Travel insurance can save you from unexpected costs and legal woes. Knowing how you’re covered is essential, from renting cars to handling personal incidents. Let’s dive into why insurance is critical in Gibraltar.

Rental Car Insurance In Gibraltar

Driving a rental car in Gibraltar? You might need additional insurance. Liability cover is a must. It protects against damage costs. Consider collision damage waivers. This covers rental car damage or theft. With it, you could avoid hefty fees. Many travel policies include rental car insurance. Check your coverage before you travel.

Personal Liability Abroad

Accidents happen. Responsible for damage or injury abroad? Personal liability cover is essential. This insurance can cover legal expenses. It also handles compensation payouts. With it, you can avoid financial strain. Always ensure your travel insurance covers personal liability. It’s peace of mind for your overseas adventure.

Reading The Fine Print

When planning a trip to Gibraltar, the excitement of exploring The Rock can overshadow the practicalities. One crucial task is examining the fine print of travel insurance. Travel insurance for Gibraltar will be your safety net. Pay attention to the details!

Understanding Exclusions And Limitations

Policy wording often describes what needs to be covered. Exclusions and limitations can impact your coverage significantly. Here are key points to check-

- Extreme sports- Activities like rock climbing may not be insured.

- Alcohol-related incidents- Problems after drinking could void your policy.

- Unattended belongings- Theft claims may need proof of secure storage.

Ensure you review the exclusions to know what situations to avoid making assumptions about your coverage.

Pre-existing Condition Waivers

Sometimes, insurers offer pre-existing condition waivers. These waivers provide coverage for medical issues you already have. To qualify, you usually must:

Requirement Details

Buy early Purchase insurance soon after booking your trip.

Be fit to travel No recent illness or injury flare-ups.

Include all trip costs Insure the total cost of your trip.

Getting a waiver means no worries about old health issues on your Gibraltar adventure. Always check the waiver requirements of your chosen policy carefully.

Choosing The Right Insurance Provider

Embarking to Gibraltar promises adventure, but savvy travelers know the importance of being prepared. With the right travel insurance, you’re not just buying peace of mind but protecting your plans from the unpredictable. Let’s navigate the process of selecting the ideal travel insurance provider together, ensuring your focus remains on the stunning views of the Rock of Gibraltar rather than on what could go wrong.

Insurance Company Reputation

Trust is vital when it comes to choosing your travel insurance. The reputation of the insurance company should be your starting point. Look for providers with high customer satisfaction and positive reviews.

- Check awards and recognitions

- Read recent testimonials

- Look for industry accreditation

A company with a solid track record will likely offer dependable service, ensuring you’re in good hands while exploring Gibraltar.

Is a passport required to travel from the UK to Gibraltar?–

A valid passport is essential for entry into Gibraltar, as it allows border authorities to verify your identity and nationality. Ensure your passport is valid and meets Gibraltar’s entry requirements.

Additionally, it’s a good idea to check for any visa requirements or travel advisories before your trip, as these can vary depending on your nationality and the purpose of your visit. You can enjoy a smooth and hassle-free journey from the UK to Gibraltar by ensuring you have the necessary travel documents.

Comparing Policies And Prices

Finding the perfect fit involves more than just glancing at the price. It requires a careful examination of what’s covered. Balance cost with coverage to make the best choice for your Gibraltar trip.

Providers A, B, and C of features

Medical emergencies Covered Covered Not Covered

Travel delays Limited Covered Covered

Baggage loss Covered Not Covered Covered

Price $50 $70 $65

Consider factors like trip cancellations, medical expenses, and emergency assistance. A comparison chart helps visualize which policy gives you the most value for your money.

Frequently Asked Questions Regarding Gibraltar Travel Insurance Needs

Is Travel Insurance Mandatory For Gibraltar?

No, travel insurance is not mandatory for visitors to Gibraltar. However, it’s highly recommended for medical emergencies, trip cancellations, and lost baggage.

What Does Travel Insurance To Gibraltar Cover?

Travel insurance for Gibraltar typically covers medical expenses, trip cancellation, lost luggage, and sometimes emergency repatriation. Coverage details vary by provider.

Can I Use Ehic In Gibraltar For Healthcare?

The EHIC card is accepted in Gibraltar, allowing access to state-provided medical treatment at a reduced cost or sometimes free.

How Much Does Gibraltar Travel Insurance Cost?

The cost of travel insurance for Gibraltar depends on trip length, coverage scope, and traveler age. It’s best to compare quotes from different insurers for the best price.

Conclusion

Embarking on a trip to Gibraltar is an adventure worth protecting. Travel insurance offers peace of mind amidst the excitement. It guards against unexpected events and financial losses. For a stress-free journey, consider a policy tailored to your needs. Safe travels, and enjoy the Rock!

I am a travel specialized writer and blogger based in the USA and UK, CANADA. I have four years of experience in travel and all types of tours. So I work on solving these issues and give various tips on these issues. I handling carefully of these issues.