Travelers Insurance settlement amounts vary depending on the case specifics. Claim factors include injury severity, policy limits, and liability.

Understanding Travelers Insurance settlement amounts can be crucial for those involved in auto accidents or other incidents covered under their policies. Settling a claim with Travelers may affect negotiations and the consideration of multiple aspects of the incident, including medical expenses, property damage, and any lost wages due to injury.

An adequate settlement not only addresses the financial impact of an accident but also ensures that policyholders feel justly compensated. To receive the best possible outcome, claimants often seek legal counsel to navigate the complexities of insurance settlements, aiming to secure a fair amount that reflects the challenges they’ve endured.

Introduction To Travelers Insurance Claims

Navigating insurance settlements can seem tricky. Travelers Insurance offers ease and confidence in this journey. This section shines a light on what Travelers Insurance does. It outlines what you should expect when you file a claim.

The Role Of Traveler Insurance In Personal Protection

Travelers Insurance stands as a guardian of your personal safety. It brings peace of mind during unexpected life events. Here’s how they protect you-

- Car Accidents- They cover vehicle repairs and medical bills.

- Home Damage- They assist with repair costs after incidents like fire or theft.

- Liability Claims- They protect you against lawsuits and injuries on your property.

What To Expect When Filing A Claim

- Contact Travelers- Reach out to report your incident. Provide all essential details.

- Claim Review- An agent will evaluate your case and guide you further.

- Settlement- If approved, they will negotiate fair compensation for your loss.

Understanding this process is vital. It ensures efficient and prompt claim handling. With knowledge comes power. You stand ready to navigate your Travelers Insurance claim.

Factors Influencing Settlement Amounts

Navigating through the details of Travelers Insurance Settlement Amounts can be mind-boggling. Several factors dictate the final settlement figure. Let’s explore these determining elements to better understand potential settlement amounts.

Policy Coverage Limits

Insurance policies have predefined limits. These are the highest sums that an insurance provider will cover. Settlements cannot exceed these policy caps. Below, find a simplified breakdown of how policy limits can influence the payout-

- Property Damage- Covers repair or replacement costs.

- Bodily Injury- Addresses medical expenses and lost earnings.

- Liability Coverage- Offers protection against legal claims.

Nature And Extent Of Damage Or Injury

The severity of injury or property damage plays a critical role. More extensive damage often leads to higher settlements.

Damage Type Example Impact on Settlement

Minor Injury Small cuts or bruises Lower settlement amounts

Significant Injury Broken bones or surgeries Higher settlement amounts

Comparative Negligence And Its Impact

Comparative negligence refers to the shared fault in an incident. If the claimant holds partial responsibility, the settlement amount is set proportionately.

- The claimant is 0% at fault- Full settlement potential.

- The claimant is 50% at fault- Settlement might be halved.

- The claimant is more than 50% at fault: Settlement severely reduced or denied.

Average Settlement Figures

Discussing Travelers Insurance Settlement Amounts can quickly become a complex topic. Yet, understanding average settlement figures is critical for anyone dealing with a claim. These amounts indicate what one might expect and provide a benchmark for comparison.

Average soft tissue injury settlement-

The average settlement for soft tissue injuries can vary widely depending on factors such as the severity of the injury, medical expenses, pain and suffering endured, and the jurisdiction where the case is being settled. Soft tissue injuries typically include sprains, strains, and bruises to muscles, ligaments, and tendons.

Settlement amounts often range from a few thousand to tens of thousands of dollars, with some cases reaching higher amounts if the injury results in significant long-term impairment or disability.

Negotiations between the injured party and the insurance company or responsible party usually determine the final settlement amount, with legal representation often assisting in securing fair compensation.

Understanding Industry Benchmarks

Insurance settlements vary greatly. Industry benchmarks are averages derived from past claims. They give a valid starting point. They are not guarantees. Each claim is unique. Benchmarks simply reflect typical outcomes.

Experts analyze past settlements. They take into account injury severity, property damage, and policy details. This analysis helps create a baseline for settlements.

Variations Across Different Types Of Insurance

Settlements differ across insurance types. Your insurance policy covers it, and the nature of your claim matters. Here are some examples-

- Auto Insurance- Claims might cover vehicle repairs or medical bills.

- Home Insurance- Settlements often involve property repairs or replacements.

- Renters Insurance- These may include reimbursement for lost or damaged items.

It’s essential to understand your policy. What does it cover? What are its limits? This is how you can predict your settlement range.

Here’s a simplified table to illustrate how settlement amounts can vary:

Insurance Type Low-End Average High-End Average

Auto $15,000 $50,000

Home $25,000 $100,000

Renter $3,000 $20,000

Note that these figures are only rough averages for demonstrative purposes.

The Negotiation Process

Getting a fair settlement from Travelers Insurance requires know-how. The negotiation dance starts with the first offer. Your counter demands guide the tango. Knowing tips and strategies boosts your final settlement. Enter the negotiating room with assurance.

Initial Offer And Demands

Travelers Insurance will propose an initial amount. This figure may fall below expectations. It’s a starting point, not the endgame. Crafting a well-reasoned response matters. It sets the stage for further discussions. Assess the first number with a critical eye.

Respond to your demands. Specify what you believe is fair. Ground your demands in facts. Use repair estimates, medical bills, and lost income proofs. Support your case with evidence. A detailed demand letter sends a strong message about your expectations.

Strategies To Maximize Your Settlement

- Record everything: Maintain an exhaustive log of all outlays.

- Communicate effectively – Be clear and steadfast in your communication.

- Know your policy – Understanding your coverages is crucial.

- Don’t rush – Take time to evaluate each offer carefully.

Engage with the insurance adjuster. Present a compelling narrative of your claim. Detail the incident’s impact. Aim to connect on a human level. Remember, adjusters handle many cases. Make yours stand out for a quicker, favorable conclusion.

Consider hiring a professional. A skilled attorney or a public adjuster adds weight to negotiations. Their expertise may turn the tide in your favor. They wield strategies proven to increase settlement amounts.

Case Studies- Successes And Challenges

When people get insurance, they hope it protects them. But sometimes, the path to a fair settlement takes work when accidents happen. It has bumps and turns. This blog looks at real cases where travelers battled for the money they deserved after bad stuff happened. We celebrate victories but also peek at the tricky parts.

Examples Of Large Settlements

People often wonder if they can get a big check from insurance companies. Yes, they can. Some have gotten a lot of money after facing tough times. Let’s see how.

- A car crash left one person very hurt. The bills piled up. But they fought hard and won. Their reward? A settlement of over a million dollars.

- Another win was after a big storm. A family’s house was ruined. They got enough money to rebuild their dream home.

- Someone got sick because of their job. They get a check that lets them get better and not worry about money.

Common Hurdles In The Negotiation Process

Getting money from insurance can be challenging. Some things can slow you down or trip you up.

Hurdle Why It’s Tough

Paperwork Mountain Heaps of forms and tricky terms can be confusing to everyone.

Fighting for Every Dollar Insurance folks play hardball. They don’t want to give more money easily.

Time Ticks Slowly: Getting an ‘OK’ on your settlement takes forever.

People should know these things so they’re ready. Being intelligent and patient helps win the insurance battle.

The Role Of Lawyers In Settlements

Understanding the crucial role of lawyers in settlements is fundamental for anyone navigating the complex process of Travelers’ Insurance claims. Securing sufficient compensation is a top priority when grappling with the aftermath of an unexpected event. A legal expert’s adept negotiations often make the difference in settlement outcomes.

When To Hire An Attorney

Deciding when to engage a lawyer can influence the trajectory of your insurance claim. The ideal timing is as follows-

- After an accident or loss, to ensure proper filing of the claim.

- If the insurance company disputes your claim.

- When high-value damages or injuries occur, expert evaluation is required.

- If settlement offers do not cover actual losses or expenses.

Enlisting legal help early avoids pitfalls and sets a strong foundation for successful negotiations.

How Legal Representation Changes The Game

An attorney not only provides legal advice but fundamentally changes how your claim is handled:

- Ensures accurate evaluation of your losses and damages.

- Strengthens your position with professional legal strategy.

- Handles complex negotiations, deflecting low-ball offers.

- Bring resources such as expert witnesses to support your claim.

- Prepares for litigation if the settlement process stalls.

Your attorney is critical in steering the settlement to fully address your financial needs and restore stability.

Securing the proper legal counsel imparts confidence and delivers the pivotal edge in advocating for your fair settlement amount with Travelers Insurance.

Traveler insurance reviews provide valuable insights into customers‘ experiences with this insurance provider. These reviews often cover various aspects such as customer service, claims processing, policy coverage, and overall satisfaction.

By reading travelers’ insurance reviews, prospective customers can decide whether Travelers is the right insurance company for their needs. Positive reviews may highlight prompt claim settlements, helpful agents, and comprehensive coverage options,

while negative reviews might point out issues with communication, claim denials, or billing discrepancies. Traveler insurance reviews are a valuable resource for individuals seeking reliable insurance coverage.

After Settlement- What Next?

Reaching a settlement with Travelers Insurance marks the end of the claims process but prompts a new question- What happens after the settlement? Understanding the steps following the agreement ensures recipients know what to expect regarding their settlement amounts. Let’s dive into the particulars of the disbursement process and the critical post-settlement considerations to anticipate.

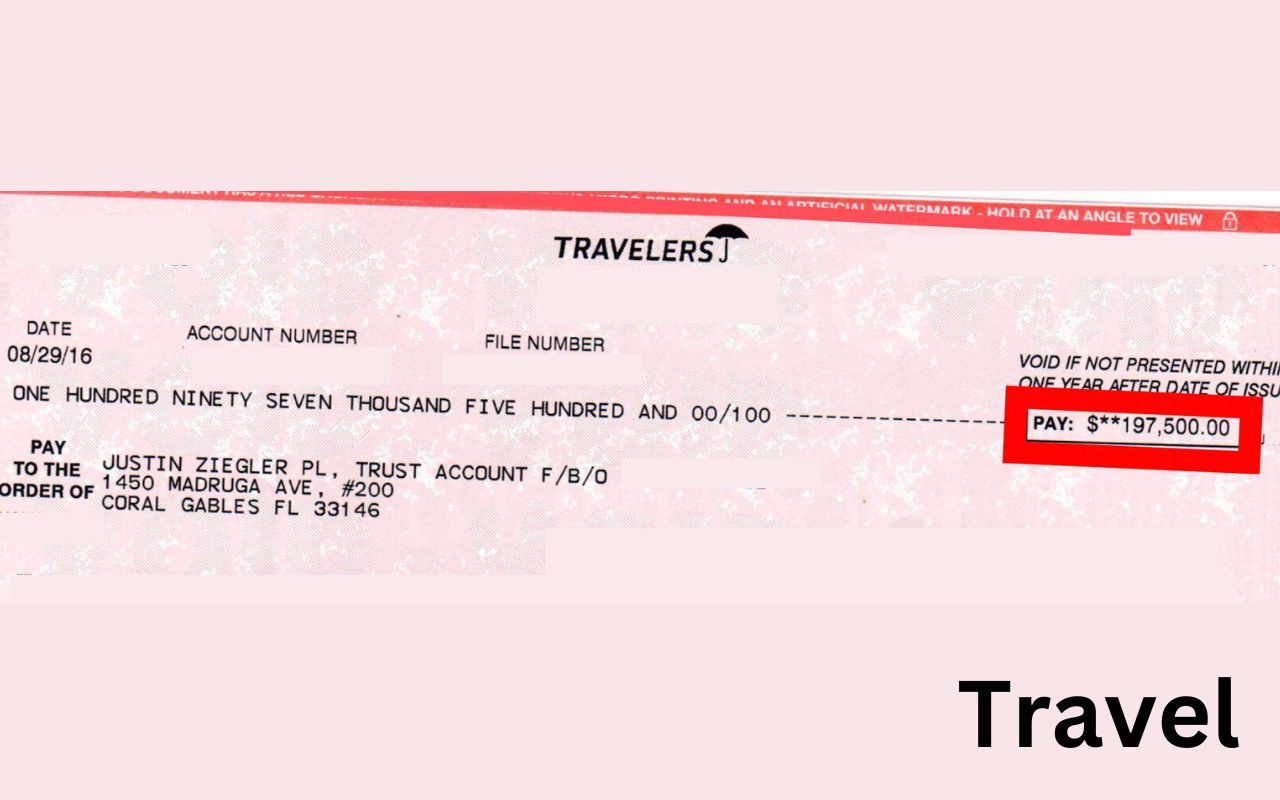

The Settlement Disbursement Process

The disbursement process begins once all parties sign the settlement agreement. The insurance company typically issues a check within the agreed timeframe, ranging from 30 to 60 days. Upon receipt, the check is usually sent to the claimant’s attorney. Here’s what typically happens next-

- Attorney’s fees and other legal costs get deducted from the total amount.

- The remaining funds are forwarded to the claimant by the attorney.

- The time it takes for the funds to reach the claimant may vary.

Communicating with your attorney is essential to understand their specific disbursement procedure. This avoids any confusion or unexpected delays.

Post-settlement Considerations

After receiving the settlement, several considerations should be on your radar. These play a crucial role in the overall settlement experience.

- Tax implications: Some settlements may be taxable. Consult a tax advisor for guidance.

- Financial planning: Consider how the settlement will affect future income and financial goals. Professional advice can be invaluable.

- Insurance policy updates: Ensure that current policies are up to date and reflect any changes due to the settlement.

Handling the sums carefully and with expert advice can improve long-term financial stability. Seek guidance where needed to best manage your settlement.

Preventing Future Claims

Travelers’ Insurance Settlement Amounts often reflect past claims, but innovative actions today can reduce future payouts. Robust prevention strategies are crucial. Businesses must stay vigilant and proactive. Effective risk management and regularly reviewing insurance coverages are keys to a secure financial future. Let’s explore how these approaches can protect your assets and make insurance costs manageable.

Risk Management Strategies

Risk management is a superhero in the insurance world. It keeps threats to a minimum. Businesses embracing these practices often see a drop in incidents. Here’s how you can take control-

- Employee Training– Equip staff with knowledge to prevent accidents.

- Maintenance Programs– Regular upkeep avoids equipment failures.

- Safety Policies– Create rules that promote a safe working environment.

Each strategy is a layer of armor against risks. Small steps today mean fewer claims tomorrow.

Regular Reviews Of Insurance Coverage

Insurance needs to change over time. Keep your coverage from gathering dust. Annual reviews are essential. They ensure your policy matches current risks. Consider these points:

- Assess business growth and its new risks.

- Update inventory lists to reflect current values.

- Check for changes in legislation that affect your coverage needs.

With regular checks, you’ll adjust coverage before it’s too late. You’ll be ready for anything. Remember—up-to-date insurance is your safety net.

Frequently Asked Questions On Travelers Insurance Settlement Amounts

What Determines Travelers Insurance Payout?

Policy coverage, claim severity, and fault determine travelers’ insurance settlements. Negotiations and assessments of the incident also influence the final amount.

How Long Does A Traveler Settlement Take?

A Travelers Insurance settlement can take several weeks to months. The timeframe largely depends on claim complexity, responsiveness of involved parties, and processing speed.

Can You Negotiate With Travelers Insurance?

Yes, policyholders can negotiate with Travelers Insurance. Providing evidence supporting your claim is essential for a better settlement outcome. Legal representation may aid in this process.

What’s The Average Payout For Traveler’s Claims?

Average payouts for Travelers claims vary widely. They depend on the accident details, policy limits, and damages incurred. There is no standard settlement amount due to these variables.

Conclusion

Understanding the complexities of Travelers Insurance settlement amounts can arm you with the knowledge to navigate your claims effectively. As each case varies, equipping yourself with insights from this discussion aids in setting realistic expectations. Patience and diligence during the claims process can lead to a favorable outcome.

I am a travel specialized writer and blogger based in the USA and UK, CANADA. I have four years of experience in travel and all types of tours. So I work on solving these issues and give various tips on these issues. I handling carefully of these issues. So, I will share this information with everyone.